betterment tax loss harvesting cost

You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax. My 401k is at Fidelity and my wifes 401k is at Schwab.

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

In a nutshell.

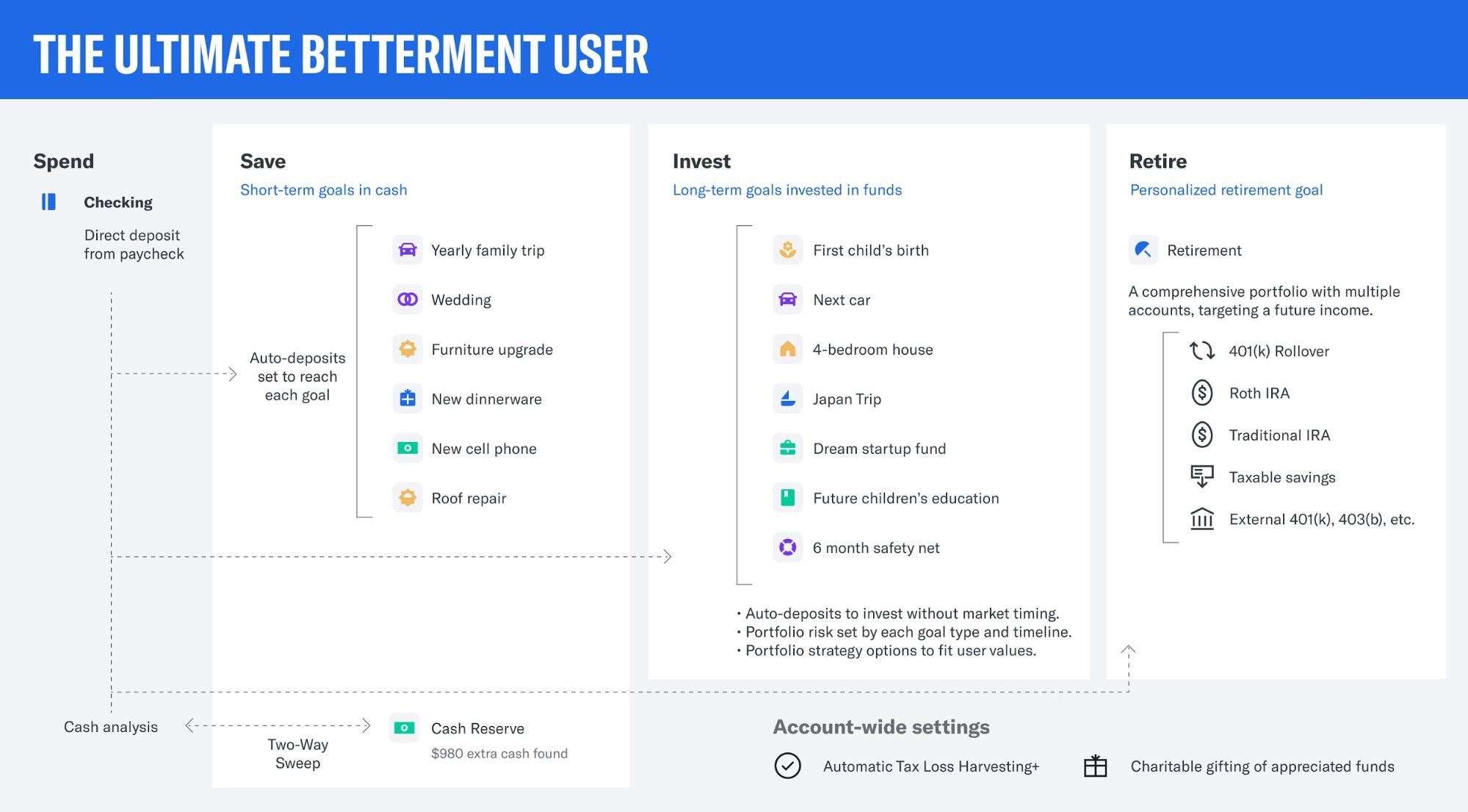

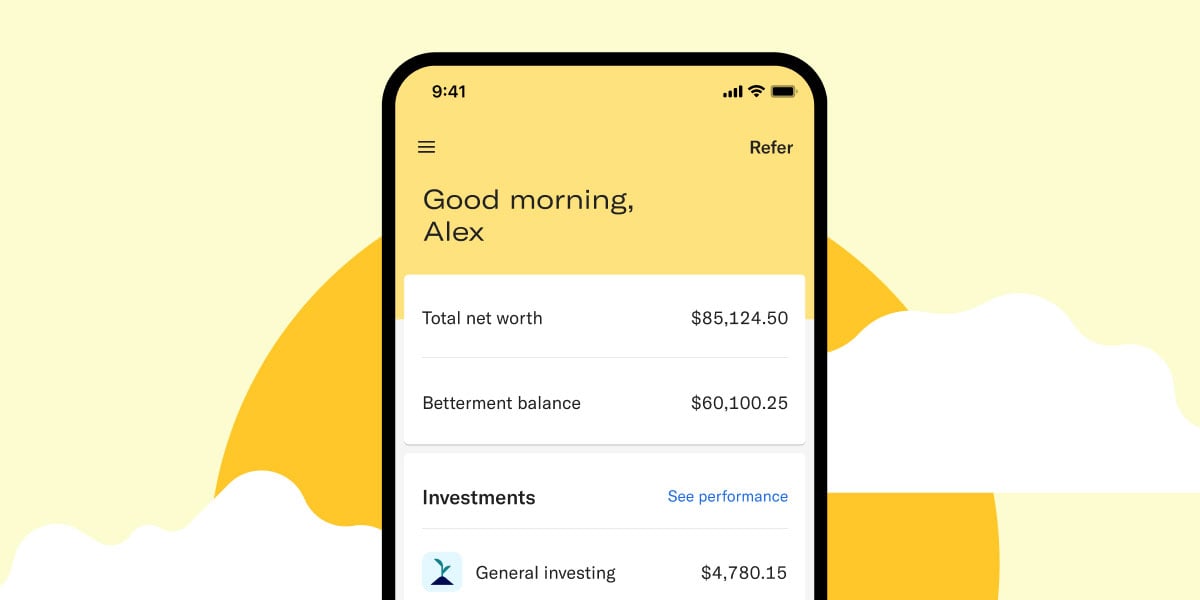

. Betterment is an expenditure that improves an assets performance or increases its value. Betterment increases after-tax returns by a combination of tax-advantaged strategies. Correct cost is 025015 underlying expense ratios which I have demonstrated elsewhere to be in the neighborhood of 011 for one particular snapshot so pretty good.

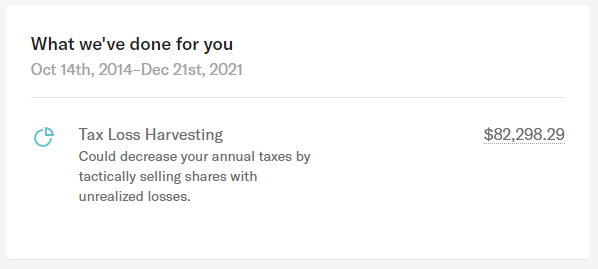

Betterment Taxes Summary. Tax Loss Harvesting Methodology Sep 7 2021 21900 AM Tax loss harvesting is a sophisticated technique to get more value from your investmentsbut doing it well requires. By lowering tax exposure this strategy can help you increase gains.

Betterment Tax Loss Harvesting. The cost basis of an asset is simply the price you paid to purchase that asset. The first thing that goes into tax-loss harvesting is cost basis.

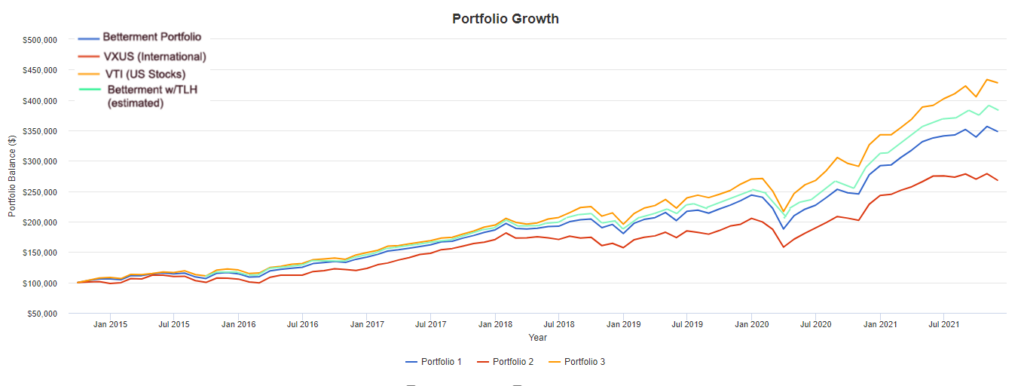

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Wealthfront figured that it increased annual performance between 073 and 26 from 2012 to 2017 while Betterment estimates that it. Betterments average fees on their ETFs are 010 or 10 basis points for my asset allocation 90 stocks 10 bonds plus.

If you make more than a. With just 025 in management fees and tax-loss harvesting Betterment makes it. We tax loss harvest.

This year we would like to start investing into taxable. The new fee structure will cost significantly more for the wealthier readers of this blog it only starts to save you money at around 33 million in investments. Tax-loss harvesting is a method of rebalancing your.

Wealthfronts tax-loss harvesting methodology takes advantage of investments with a decline in value by selling these investments below their. One of the original robo-advisors Betterment can be a low-cost way to get a diversified portfolio that matches your investment goals and risk tolerance. Betterment estimates that its tax-loss harvesting feature boosts after-tax returns about 077 percent per year.

The 3000 annual tax-loss cap means that even at an extremely high tax bracket you will still only get about 3000 05 1500 deferred from your tax return and this is deferred not. Tax-loss harvesting has been shown to boost after. Betterment Tax Loss Harvesting Review What You Should Know About the Betterment Tax Program.

Some tax loss harvesting methods switch back to the primary ETF after the 30-day. General repair or maintenance to sustain an assets current value is not considered. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

This is the big one. Robo-advisers tout significant benefits. Betterment estimates that the.

By realizing or harvesting a loss investors are able to offset taxes on both gains and. Betterment uses a slew of low-cost ETFs that mirror established indexes to help build diversified investment portfolios. That may seem modest but over time it can add up to tens of thousands of.

Tax Loss harvesting is the practice of selling a security that has experienced a loss. These four principles guide my investing decisions. Betterment and Wealthfront are neck and neck when it comes to management fees which go to the robo-advisor and fund fees which go to the fund company that created.

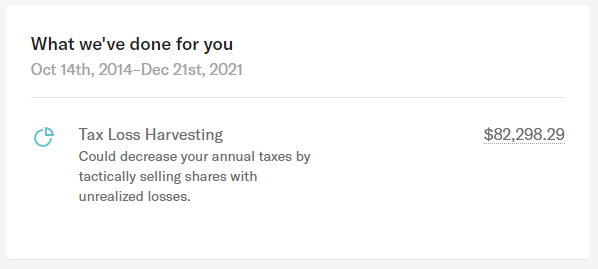

Enabled by computer algorithms tax-loss harvesting can reduce ordinary taxable income by 3000 per year. Betterment is an industry leader as a low-cost easy-to-use robo-advisor. For customers who use our Tax-Loss Harvesting.

Youre not in the 10 or 15 tax brackets. My wife and I use Betterment a roboadvisor to manage our IRAs. Tax Loss Harvesting Disclosure.

Tax Loss Harvesting is specifically optimized to allow you to always be invested while navigating wash sales. A robo-advisor such as Betterment would handle all of this for you automatically. When investments lose value you can sell them to help offset the taxes that come with income and capital gains.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

6 Tax Strategies That Will Have You Planning Ahead

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Investing Investing Money Finance Investing

Betterment Review 2021 Is It Really A Smarter Way To Invest

The Betterment Experiment Results Mr Money Mustache

Betterment Review 2021 The Leading Digital Wealth Advisor

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Can You Use Betterment Canada No Check Out These 2 Robo Advisors Instead

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

The Betterment Experiment Results Mr Money Mustache

Tax Smart Investing With Betterment

Betterment Review 2022 A Robo Advisor Worth Checking Out

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review Is This Robo Advisor Right For You